The global manufacturing landscape is undergoing a profound transformation driven by automation and digitalization, creating broader opportunities for advanced laser welding technologies. Industry data shows that investments in digital tools are accelerating, with around 62% of enterprises planning to increase spending on cloud computing within the next five years. This digital shift is particularly evident in production automation, where laser welding machines are playing an increasingly vital role in enabling precision, efficiency, and intelligent manufacturing. From 2025 to 2030, the global laser welding machine market is projected to achieve a compound annual growth rate (CAGR) of more than 5%.

ZS Laser takes a closer look at market trends, as well as segmentation by technology, applications, and regional distribution.

Laser Welding In Industry

Laser Welding Machines Market Trends

Expanding Industrial Automation

The push for industrial automation in manufacturing is driving demand for laser welding machines. Factories require higher efficiency, fewer human errors, and stable welding quality—making automated welding equipment a critical solution. Around 62% of enterprises plan to increase cloud computing investment, while nearly 50% are focusing on AI, IoT, and manufacturing automation tools.

Tight labor markets and structural workforce challenges are further accelerating the adoption of automation, and laser welding is no exception. By 2030, over 40% of Europe’s population will be aged 50 or above, forcing manufacturers to depend more on automation to maintain productivity. Since conventional welding relies heavily on skilled labor—which is in short supply worldwide—automated laser welding systems have become a key investment. With minimal manual intervention, they deliver precision, consistency, and efficiency, helping manufacturers overcome labor shortages.

Rapid Growth in EV Battery Manufacturing

The surge in electric vehicle (EV) battery production is a major driver of demand for laser welding machines. Laser welding is indispensable in critical steps such as electrode stacking, tab welding, and cell sealing. It ensures precise, fast, and reliable welding for modules, packs, and cells while aligning with the EV industry’s carbon reduction and energy efficiency goals.

Leading laser source manufacturers—including IPG, Raycus, and Maxphotonics—have launched products tailored to EV applications. Responding to market demand, ZS Laser has introduced pulsed laser welding machines designed specifically for lithium battery welding. These machines are optimized for heat-sensitive and dissimilar materials (e.g., copper-aluminum or copper-steel), offering superior performance on reflective or volatile metals while reducing spatter, cracks, and porosity.

Innovation in Laser Welding Technologies

Technological innovation continues to expand laser welding capabilities in terms of precision, speed, and scalability. Novel wavelength and power configurations are extending application ranges. For example, nLIGHT’s “Element” fiber laser series (with 105 µm fiber delivery and 90 W brightness per module) demonstrates high performance and scalability. Chinese domestic laser brands have also introduced competitive, cost-effective alternatives. With ongoing advancements, laser welding is moving toward more specialized industrial applications.

Manufacturing Industry Development

The transformation of global manufacturing is fueling demand for flexible and efficient production, benefiting laser welding machine makers. Data on global manufacturing value added shows major contributions from different sectors: automobiles (1.144%), consumer goods (2.944%), and industrial goods & services (0.8888%).

Manufacturers are also demanding higher connection accuracy and the ability to process new material combinations. Investments in digital tools and advanced technologies are improving process transparency, efficiency, and real-time monitoring. As innovation continues, the welding equipment market is expected to enter a new growth cycle.

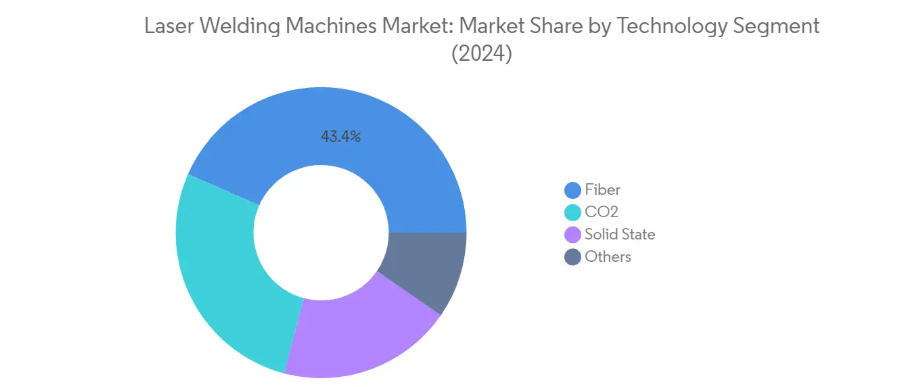

Laser Welding Machine Market Segmentation by Technology

Fiber Lasers: The Core Growth Driver

Fiber lasers dominate the global laser welding market, accounting for around 43% of market share in 2024. Their advantages include long lifespan, low maintenance cost, stability, and excellent price-performance ratio. With rising consumer demand and intensified competition among manufacturers, fiber laser prices have fallen, making cutting, welding, and marking systems more accessible.

Another key advantage is their ability to transmit beams via flexible fiber cables, allowing high-precision welding in complex geometries and hard-to-reach areas—further strengthening their market leadership.

Laser welding machine market: Market share by technology sector (Photo Credit: Mordor Intelligence)

Solid-State Lasers: The Fastest-Growing Segment

From 2024 to 2029, the solid-state laser segment is expected to achieve the highest CAGR of about 7%. This growth comes from ongoing innovation, leading to better performance, higher reliability, and reduced costs. Solid-state lasers are particularly beneficial in automotive manufacturing and tailored blank welding. They offer higher electro-optical efficiency, lower energy consumption, and faster welding speeds. Compared to conventional systems, they can cut cooling and power consumption by up to 50%, making them attractive for sustainable manufacturing.

Other Laser Technologies

CO₂ lasers remain important for heavy-duty applications, offering high power for cutting and welding thick materials. Meanwhile, semiconductor lasers are gaining traction in electronics and medical device manufacturing, where ultra-precise, small-scale welding is required. Together, these technologies diversify the market, enabling specialized solutions for multiple industries.

Market Segmentation by Application

Automotive Industry

The automotive sector is the largest application area, contributing about 31% of market share in 2024. Laser welding is widely used in body-in-white assembly, EV battery manufacturing, and lightweight component production. Its speed, accuracy, and adaptability make it indispensable for modern automated production lines. The rapid growth of EVs further drives demand for advanced welding solutions, especially in battery modules, thermal management, and structural components.

Medical Industry

The medical sector is the fastest-growing application, with an expected CAGR of about 8% between 2025 and 2030. Growth is driven by the demand for precision, contamination-free welding in devices such as pacemakers, hearing aids, and surgical instruments. As minimally invasive surgery advances, demand for smaller, more complex devices rises. Laser welding enables non-contact, sterile, and high-precision joins, ensuring compliance with strict quality standards. Microlaser welding innovations are further unlocking possibilities for ultra-small device manufacturing.

Laser Welding In Medical Industry

Other Applications

Beyond automotive and healthcare, laser welding is applied across electronics, jewelry, tools, and mold manufacturing.

In electronics, it is used for semiconductor packaging, microelectronic assembly, and consumer device production.

In jewelry, it enables fine welding of precious metals and intricate designs.

In tooling and molds, it provides precision repair and structural reinforcement, extending tool lifespan.

In aerospace, energy, and general manufacturing, it supports complex material joining and specialized requirements, showing strong growth potential.

Market Segmentation by Region

North America

In 2024, North America held about 21% of the global market, supported by expanding EV battery manufacturing. Georgia, Kentucky, and Michigan are becoming hubs, with expected EV battery capacities of 97–136 GWh by 2030. Precision manufacturing—including medical devices, metalworking, and hydraulic systems—also boosts demand. Continuous innovation by local players has established North America as a strategic growth region.

Europe

Europe’s laser welding market grew by 27% between 2019 and 2024, making it a stronghold for advanced manufacturing. Over half of demand comes from the automotive industry, with Germany, France, and Italy leading production. With EV battery capacity expansion and laser plastic welding for advanced driver-assistance systems (ADAS), the region continues to invest heavily in innovation.

Asia-Pacific

The Asia-Pacific region is projected to see the fastest growth, with a CAGR of about 37% from 2024 to 2029. China dominates with a robust manufacturing ecosystem supported by major companies such as Han’s Laser, HGTECH, and Penta Laser. Electronics manufacturing strengthens its position, with applications in smartphones, tablets, and laptops.

India is emerging as a competitive market with policy support and fair-trade enforcement, while Japan and South Korea are expanding EV battery capacity. With cost advantages, skilled labor, and strong investment, Asia-Pacific is set to remain the primary global growth engine.

Latin America

Latin America is witnessing transformation due to expanding automotive and electronics industries. Brazil leads in automotive assembly, followed by Argentina and Colombia, while Chile is a fast-growing market. Argentina established the region’s first lithium battery factory, highlighting the strategic push toward EV manufacturing. Supported by FDI, automation, and skilled workforce development, the region is attracting growing interest from welding equipment suppliers.

Middle East & Africa

The Middle East and Africa are also entering a new growth phase, driven by investments in automotive and EV battery production. Morocco is building a giga-factory for EV batteries, while Turkey is expanding its capacity. The GCC (especially UAE and Saudi Arabia) is seeing fast automotive growth, supported by government policies promoting industrial diversification. With automation, advanced technologies, and new facilities, the region offers strong opportunities for laser welding machine manufacturers.

Take the Next Step with ZS Laser

As the laser welding machine market continues to expand, staying ahead requires choosing the right partner with proven expertise and innovation. With over 10 years of industry experience, CE certification, and a strong track record in delivering customized welding solutions, ZS Laser is ready to support your business in navigating this transformation.

👉 Contact us today to discuss your specific requirements, schedule a factory visit, or request a free welding sample test. Let ZS Laser help you unlock the full potential of advanced laser welding technology for your production.

Disclaimer:

Some of the market insights and statistical data cited in this article are referenced from publicly available information, including industry research such as reports published by Mordor Intelligence. ZS Laser acknowledges these sources, and the content has been further analyzed, interpreted, and integrated to provide readers with an informative overview of the laser welding machine market.

ZS Laser Equipment

ZS Laser Equipment

WhatsApp

Scan the QR Code to start a WhatsApp chat with us.